Human beings are inherently emotional beings. We let our lives and our decisions be governed more by emotions and less by facts and numbers. We took global warming more seriously when our social media was overwhelmed with heartbreaking pictures of burnt koalas and kangaroos during the bushfire. Such a response is completely absent, and no one talks about the many thousand terrestrial and aquatic animals that die every day and the million species that are facing probable extinction. We are hard-wired to think emotionally, and numbers do not appeal to us in a way that emotions do. We take a disaster seriously only when we see colossal damage to our cities, disfigured bodies slain on the roads and small infants desperately searching for their long-dead parents. This is the reason why there was so little response to the 2008 crisis and why most of us have no idea what it even is. Apparently, the housing crisis didn’t deserve our attention because no bullets were fired, no cities reduced to dust and no one was killed (although more than 10,000 suicide cases in the US alone can be directly linked to it). If you could teleport yourself during this time, you would find yourself in a very difficult situation. You have been recently laid off from your job with a massive student loan making your future look very very gloomy. Your house which was once worth quite a lot of money is now worthless. Your retired, once wealthy parents have lost all their savings, investments and pensions and are now dependent on you. And to top it all, there are no employment opportunities for you until the economy stabilizes. This storm swallowed about $5 trillion in pension funds, real estate value and household saving. In the US alone, nearly 8 million lost their jobs and about 6 million lost their homes. Good luck imagining the utopian lives with dynamism and abundance in such a scenario that we all dream of today. Just because it isn’t visible doesn’t imply that the damage isn’t there. Just because its all happening is an industry that’s very remote from your everyday life doesn’t make you impervious to its effects.

The collapse of banks and housing markets, in general, is not a new phenomenon. We have seen this happen a few times in the past, but never before did it brought down the entire economy with it. We’ll be looking at exactly what made a small housing market collapse morph itself into a worldwide economic fiasco. Just a heads up, this one is a bit tricky and one post won’t give you all the “feel” that I intend to deliver. So it would be coming out in 2 parts. Without further ado, let’s just dive in.

Our story starts way back in the early 2000s during the dot-com bubble, a period from 1994 to 2000 which saw a rapid rise in technology companies of the likes of PayPal, Amazon and eBay. Long story short, tech companies started popping out everywhere and showed potential. Investors saw this as a huge opportunity and started blindly funding them. This was the California gold rush of recent times. Everyone was dreaming of becoming a tech entrepreneur and amassing billions. And just like the gold rush, this bubble burst in the 2000s when the investors finally realized that the tech was cool but nobody wanted to buy them. So baring a few, everyone went bust and guess what happens when a lot of companies go bankrupt? Economic slowdown!!

At this point, Alan Greenspan, the chairman of the federal reserve (RBI of US, subsequently referred to as fed) lowered the interest rates to just 1%. Plainly stated, if you borrow money from the federal reserve, you will have to pay just a rupee on every 100 that you borrowed. Greenspan did this so that people can borrow money easily, use the money to start new businesses and this would in turn, kickstart the economy again. What he didn’t anticipate was the effect these cheap loans would create on a longer time frame. Banks could now borrow a lot of money from the fed very very cheaply. This in turn allowed them to loan out more money than before to common folks. Banks, in general, are very willing to extend mortgage loans to people who want to buy houses. Why? Because banks would get monthly repayments on these mortgages and even if the person defaults, banks get to keep his house which they can always sell. This works beautifully in a situation where housing prices are always increasing, which has been the case almost everywhere in the world for the past countless decades. So, cheap loans that the fed was offering made banks happy because they can now extend more mortgage loans and earn even more money. It also made normal people happy because they could now get home loans easily and have their own house. So everyone was happy, except for the ‘super-rich’ folks who were looking for a good place to park their excess money. Seeing banks and people happy, ‘super-rich’ folks also wanted a piece of the action.

Seeing the demand from the ‘super-rich’ folks, banks decided to milk them and came up with something known as a ‘Mortgage Bond’. Wall Street deliberately tries to make things sound complicated to give the impression that only they can do what they do. Mortgage Bond is nothing but a box filled with mortgage loans from the banks. So rich guys can buy these boxes and earn a good return on the mortgage loans without the hassle of actually giving out loans to common folks. These were a much better investment, so rich folks started buying a lot of these. In fact, these boxes(bonds) became so famous that banks started falling short of mortgages to put in them. A lot of people wanted these boxes but there weren’t enough mortgages to put in these boxes. Apart all, there are only so many homes and so many people with good enough jobs to buy them. So the obvious thing the banks thought to do was to extend more loans, make more of these boxes and keep the profit machinery churning. Banks started lending more and more riskier loans in order to put them in these bonds. Loans were extended like crazy to people with no permanent income, not even bothering to check their repayment capacity. Most of these people were poor and immigrants who had no idea how even the mortgages worked. Banks knew that they could utilize this confusion and innocence for their profits, so they came up with more and more crooked ways to make people take these loans. Everyone who wanted a house could get one irrespective of his/her financial situation. In California, for example, a Mexican strawberry picker with an annual income of just $14,000 was lent every penny he needed to buy a house for a quarter of million bucks. Or talk about a Jamaican caretaker who awned six bungalows in queens. All of these loans given out on a single assumption that if these people default, banks can always sell these houses back for a profit because well, housing prices always increase. P.S All these loans that were extended to people who couldn’t afford to repay them are known as Subprime loans. So the next time you hear the word ‘subprime’, think SHIT.

I think before we move any further, you guys should know what a credit rating is and how does that works. A credit rating is exactly like a movie rating like IMDB or rotten tomatoes but instead of movies, we have these securities (anything that is bought or sold in the financial system). So a 5-star rating is something like a “AAA” and a 1 star is somewhere close to a “B” or a “CCC”. The better is the rating, the less risky the security is and lower are its chances of default. These ratings are given out by independent agencies and are universally accepted as being correct. And just like we check out movie ratings before watching a movie, investors tend to rely on these ratings heavily before taking their investment decisions.

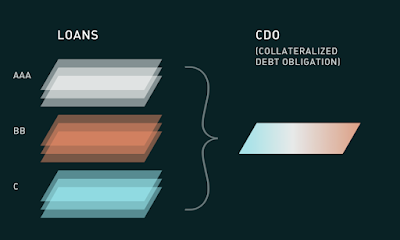

The Mortgage bonds or the boxes that we earlier talked about were actually different types of boxes ranging from the safest ones to the riskiest ones. The safest ones had all the good loans packed inside them and were sold off to the investors. Then there were these bad loans bundled with some good loans and sold as a moderately safe box to people with more risk appetite such as hedge funds. But what about the box that contained all the sub-prime(bad) loans which were bound to fail that no one wanted to buy? The bankers definitely wouldn’t let it just warehouse in their books, so they came up with something even more complicated and mind-boggling. This goes by the name of a CDO or a Collateralised Debt Obligation. It’s basically a bigger box that contains all these unsold smaller boxes. These smart bankers combined all of the bad, unsold stuff into a big box and then managed to convince the rating agencies to give this new box a “AAA” (5 star). So the earlier bonds which were of 1-star ratings were combined with similar bonds and then the rating agencies agreed to give this new box a 5-star rating.

Let’s look at this again because this is important. A CDO is what allowed a housing crisis to morph into a worldwide economic disaster. Let’s say I’m a sweet seller with a big shop and a good market reputation. I have countless different mouthwatering varieties of sweets available in my shop. I obviously profit immensely from this but sometimes some sweets just don’t sell. Maybe they don’t look that tempting or maybe too few quantities of them is left to sell. Whatever might be the reason, I don’t like to take a loss on these unsold sweets. So I take all those unsold sweets, put them in a nicely decorated multi-section box and sell this as “Assorted sweets”. And the best part is, people who buy these assorted sweet boxes think they are actually getting the best sweets while in fact they are buying everything that’s stale and didn’t sell initially. The sweets are our original bonds and these “Assorted box” is our CDO.

The obvious question that arises at this moment is, why did the rating agencies agree to rate these CDOs “AAA” even when they were really bad? Well, for starters, these rating agencies had no idea how to assess these boxes because they were fairly complicated. I have deliberately simplified a lot of things but these securities(boxes) were highly complicated ones that only the people who made them could understand. And there was also the competition between these rating agencies. Rating agencies were paid for the ratings that they give and so if one of them doesn’t give the banks their ratings, they would lose their business to some other credit rater. So even a big box containing all the little boxes filled with extremely bad subprime loans ended up being marked as safe AAA. And it Turns out this is all the investors check before buying them. So not only were the house owners duped but the investors ended up being tricked as well.

I can totally relate if you didn’t get a “feel” or are totally lost because some of this stuff is pretty complicated. I mean the crisis would have never taken place if the stuff was straightforward right? I get this would be the right time to take a break and give you guys time to let everything sink in. I am attaching a few resources for some you who have that inquisitive bug inside them. And it would be sometime before the final part gets published, so feel free to bug me in between with all your questions and thoughts.

Resources:-

The collapse of banks and housing markets, in general, is not a new phenomenon. We have seen this happen a few times in the past, but never before did it brought down the entire economy with it. We’ll be looking at exactly what made a small housing market collapse morph itself into a worldwide economic fiasco. Just a heads up, this one is a bit tricky and one post won’t give you all the “feel” that I intend to deliver. So it would be coming out in 2 parts. Without further ado, let’s just dive in.

At this point, Alan Greenspan, the chairman of the federal reserve (RBI of US, subsequently referred to as fed) lowered the interest rates to just 1%. Plainly stated, if you borrow money from the federal reserve, you will have to pay just a rupee on every 100 that you borrowed. Greenspan did this so that people can borrow money easily, use the money to start new businesses and this would in turn, kickstart the economy again. What he didn’t anticipate was the effect these cheap loans would create on a longer time frame. Banks could now borrow a lot of money from the fed very very cheaply. This in turn allowed them to loan out more money than before to common folks. Banks, in general, are very willing to extend mortgage loans to people who want to buy houses. Why? Because banks would get monthly repayments on these mortgages and even if the person defaults, banks get to keep his house which they can always sell. This works beautifully in a situation where housing prices are always increasing, which has been the case almost everywhere in the world for the past countless decades. So, cheap loans that the fed was offering made banks happy because they can now extend more mortgage loans and earn even more money. It also made normal people happy because they could now get home loans easily and have their own house. So everyone was happy, except for the ‘super-rich’ folks who were looking for a good place to park their excess money. Seeing banks and people happy, ‘super-rich’ folks also wanted a piece of the action.

Seeing the demand from the ‘super-rich’ folks, banks decided to milk them and came up with something known as a ‘Mortgage Bond’. Wall Street deliberately tries to make things sound complicated to give the impression that only they can do what they do. Mortgage Bond is nothing but a box filled with mortgage loans from the banks. So rich guys can buy these boxes and earn a good return on the mortgage loans without the hassle of actually giving out loans to common folks. These were a much better investment, so rich folks started buying a lot of these. In fact, these boxes(bonds) became so famous that banks started falling short of mortgages to put in them. A lot of people wanted these boxes but there weren’t enough mortgages to put in these boxes. Apart all, there are only so many homes and so many people with good enough jobs to buy them. So the obvious thing the banks thought to do was to extend more loans, make more of these boxes and keep the profit machinery churning. Banks started lending more and more riskier loans in order to put them in these bonds. Loans were extended like crazy to people with no permanent income, not even bothering to check their repayment capacity. Most of these people were poor and immigrants who had no idea how even the mortgages worked. Banks knew that they could utilize this confusion and innocence for their profits, so they came up with more and more crooked ways to make people take these loans. Everyone who wanted a house could get one irrespective of his/her financial situation. In California, for example, a Mexican strawberry picker with an annual income of just $14,000 was lent every penny he needed to buy a house for a quarter of million bucks. Or talk about a Jamaican caretaker who awned six bungalows in queens. All of these loans given out on a single assumption that if these people default, banks can always sell these houses back for a profit because well, housing prices always increase. P.S All these loans that were extended to people who couldn’t afford to repay them are known as Subprime loans. So the next time you hear the word ‘subprime’, think SHIT.

I think before we move any further, you guys should know what a credit rating is and how does that works. A credit rating is exactly like a movie rating like IMDB or rotten tomatoes but instead of movies, we have these securities (anything that is bought or sold in the financial system). So a 5-star rating is something like a “AAA” and a 1 star is somewhere close to a “B” or a “CCC”. The better is the rating, the less risky the security is and lower are its chances of default. These ratings are given out by independent agencies and are universally accepted as being correct. And just like we check out movie ratings before watching a movie, investors tend to rely on these ratings heavily before taking their investment decisions.

The Mortgage bonds or the boxes that we earlier talked about were actually different types of boxes ranging from the safest ones to the riskiest ones. The safest ones had all the good loans packed inside them and were sold off to the investors. Then there were these bad loans bundled with some good loans and sold as a moderately safe box to people with more risk appetite such as hedge funds. But what about the box that contained all the sub-prime(bad) loans which were bound to fail that no one wanted to buy? The bankers definitely wouldn’t let it just warehouse in their books, so they came up with something even more complicated and mind-boggling. This goes by the name of a CDO or a Collateralised Debt Obligation. It’s basically a bigger box that contains all these unsold smaller boxes. These smart bankers combined all of the bad, unsold stuff into a big box and then managed to convince the rating agencies to give this new box a “AAA” (5 star). So the earlier bonds which were of 1-star ratings were combined with similar bonds and then the rating agencies agreed to give this new box a 5-star rating.

Let’s look at this again because this is important. A CDO is what allowed a housing crisis to morph into a worldwide economic disaster. Let’s say I’m a sweet seller with a big shop and a good market reputation. I have countless different mouthwatering varieties of sweets available in my shop. I obviously profit immensely from this but sometimes some sweets just don’t sell. Maybe they don’t look that tempting or maybe too few quantities of them is left to sell. Whatever might be the reason, I don’t like to take a loss on these unsold sweets. So I take all those unsold sweets, put them in a nicely decorated multi-section box and sell this as “Assorted sweets”. And the best part is, people who buy these assorted sweet boxes think they are actually getting the best sweets while in fact they are buying everything that’s stale and didn’t sell initially. The sweets are our original bonds and these “Assorted box” is our CDO.

The obvious question that arises at this moment is, why did the rating agencies agree to rate these CDOs “AAA” even when they were really bad? Well, for starters, these rating agencies had no idea how to assess these boxes because they were fairly complicated. I have deliberately simplified a lot of things but these securities(boxes) were highly complicated ones that only the people who made them could understand. And there was also the competition between these rating agencies. Rating agencies were paid for the ratings that they give and so if one of them doesn’t give the banks their ratings, they would lose their business to some other credit rater. So even a big box containing all the little boxes filled with extremely bad subprime loans ended up being marked as safe AAA. And it Turns out this is all the investors check before buying them. So not only were the house owners duped but the investors ended up being tricked as well.

I can totally relate if you didn’t get a “feel” or are totally lost because some of this stuff is pretty complicated. I mean the crisis would have never taken place if the stuff was straightforward right? I get this would be the right time to take a break and give you guys time to let everything sink in. I am attaching a few resources for some you who have that inquisitive bug inside them. And it would be sometime before the final part gets published, so feel free to bug me in between with all your questions and thoughts.

Resources:-

2. "The Big Short" on Netflix.

Until then….Happy Investing

- Nikhil Mudholkar

Until then….Happy Investing

- Nikhil Mudholkar

Could you also talk about how the situation is of these credit rating agencies now?

ReplyDeleteAnd, if they were like the major reason for the failure of the economic system, do the banks still rely them for mortgage/bond/securities ratings?

Yes, banks still pretty much rely on them. One major reason that these agencies gave for their failure was the complexity of these securities. Also there were some loopholes in the way the ratings worked which these smart bankers figured out and exploited. For example, we all know that each of us has a credit score or a FICO score that is an indicator of our credit worthiness in the market. The models of these rating agencies used average fico scores of people rather than individual scores. So if you could bundle together a very low score person with a high scorer, the average would still appear safe while in practice one of them is extremely risky. There were some other loopholes such as it didn't differentiate between thin file and thick file fico scores etc.

ReplyDelete