Not so far from there, on the trading floor of Royal Bank of Canada (RBC), Brad Katsuyama was frustrated with the new electronic system that his company had put in place. His cause of worry was simple, the market was no longer what his computer screen showed him. Not so long ago, if his computer showed him that there were 10,000 shares of apple available in the market, then he could get those 10,000 shares. Now, the computer did show 10,000 shares available but as soon as he pressed the buy button, the market changed and he could only get a fraction of it, say 2000. The remaining 8000 were now available at a higher price for him to buy. It was as if someone already knew what he wanted to buy, bought it before him and was trying to sell it back at a higher price. Why was this happening in the first place and what exactly changed in the market that made them so unpredictable and the trading systems so inaccurate?

|

| The entire HFT ecosystem |

|

| Electronic front running |

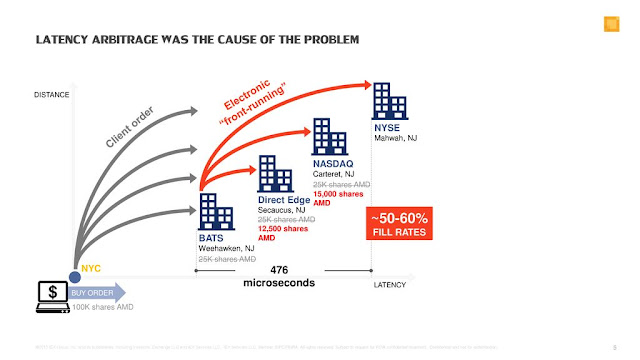

- Electronic front running:- Electronic front running is what was happening with Brad earlier when he couldn’t get all of his shares. Consider 3 exchanges located in Mumbai, Delhi and Bangalore. Now in a regular market scenario, our earlier 10,000 shares would be distributed across all the 3 exchanges( In total they have 10,000 available). In an ideal scenario, when Brad pushes the buy button, all his orders reach the exchanges simultaneously and he is thus able to buy them all. But in reality, there is a slight time interval between the orders reaching the exchanges. This happens because one exchange is located geographically closer to you than the other. It's like you are sitting in Mumbai and sending orders to exchanges located say in Mumbai, Delhi and Bangalore. Your orders will obviously reach Mumbai exchange a few milliseconds earlier than Delhi and Bangalore ones. The HFT servers located next to the Mumbai exchange would immediately deduce that there is a large investor willing to buy a tonne of apple shares and then race with your orders to the other exchanges. Simply put, they will try to buy all the shares that are available on Delhi and Bangalore exchange before your order reach these exchanges. And since these guys have cutting edge servers and the fastest possible technology, this challenge is a piece of cake for them. Once they are able to buy all these apple shares, they could sell the same to you in the next millisecond for a few cents higher than the market price. Now a few pennies won’t seem much but they amount to thousands of dollars when typical share volumes go as high as millions of shares.

- Rebate Arbitrage:- Its a strategy employed by the HFTs to make the money while participating in something known as market-making. Essentially, market makers take the opposite side of the trade that you and I want to get into. For those who want to sell, the market makers will buy from them and for the people who wanna buy, the market makers will sell to them. They ensure that you could always buy and sell your shares because they would get into a trade with you even if no one in the market is willing to. (This is what is liquidity-its the ease at which you could find a counterpart for the trade) The market maker may purchase say, 1000 shares of IBM for $100 each (the bid price) and then offer to sell them to a buyer at $100.05 (the ask price). The difference between the ask and bid price is only $.05, but by trading millions of shares a day, they manage to pocket a significant chunk of change.

- Slow market arbitrage:- Sometimes situations arise in the markets when the same stock is available at different prices at different exchanges and market arbitrages is a way to exploit this in a riskless way. Market arbitrage is considered to be a riskless activity because traders are simply buying and selling equal amounts of the same stock at the same time. Let’s say our good ol’ IBM is being traded on both The New York and The London stock exchanges. On NYSE it’s being offered for say $10 and on the London Exchange for $10.01. So If I can quickly buy the stock at NYSE and sell it simultaneously on the London exchange, I stand to make a profit of $0.01 on each share. Factor in millions of shares and you stand to make thousands of dollars with practically no risk. HFTs are very well equipped to leverage this opportunity given the immense speed and capital that these guys possess.

|

| HFT trading volume |

Clearly frustrated and pained by just how unfair the system was for ordinary investors, Brad (The same RBC guy) was one of the first ones to do something about it. He planned to start a completely fair stock exchange with special systems in place to protect the investors from the HFT attacks. Systems such as the one that deliberately introduced a “delay” of 350 microseconds which nullified any speed advantages that HFTs had. The exchange was designed differently from the very foundation to ensure that it does not systematically favour a certain group of individuals. Since investors were a centrepiece, this new exchange was named the “Investor’s Exchange” or IEX. IEX obviously had problems of their own. These guys were trying to fix the broken sloth machine that nobody wanted them to fix. Banks and brokerage house were not willing to send their orders to IEX because who cares if investors get a fair price for their stocks when one can profit off their innocence.

|

| IEX total market share |

This way of wall-street was obviously unsustainable and it was only a matter of time before the high-ups on the Wall Street, the guys actually pulling the strings started coming to their senses. Surprisingly the first one willing to change was Goldman Sachs, the very Goldman Sachs that was knee-deep in this HFT business. Goldman had a regime change and the 2 new partners responsible for its trading business- Ron Morgan and Brian Levine were in a way “not HFT types”. They were quick to figure out that this endless thirst for greater and greater speeds is not sustainable. The world had just woken up from a terrible 2008 financial disaster and banks like GS were already in a tight spot. So on 19th Dec 2013 at 3:09:42 p.m, GS took its first step towards fair and efficient markets by sending its order of about 40 million trades to the IEX. This was by far the largest order that the IEX received until then and paved the way for other big players in markets to accept this new, supposedly fair exchange. IEX has come a long way since then from needing at least 50 million shares a day to break even to trading about 300 million shares a day by the end of 2018.

This post might make it seem that I am against HFT but that’s fastest from being the truth. It’s not as if I am against the speed and this nature of trade. There’s nothing illegal about it and in fact, it does make markets more accurate by ensuring that prices adjust to the new information a few milliseconds faster. But the cost that’s being paid far outweighs the benefits. There’s the obvious cost of fairness and the stability of the system. But a far more important, yet hard to measure cost is the influence all this market-gaming exerts on the lives of people. The more money to be made gaming the financial markets, the more the people would decide that they were put on earth to game the financial markets - and create romantic narratives to explain to themselves why a life spent gaming the markets is a purposeful life. Once smart people are paid huge sums of money to exploit the flaws in the financial system, they have even more incentive to screw up the system further. HFT is an extremely innovative way to earn money, it's just that sometimes it operates ethically in a slightly grey area. I personally find them extremely intriguing and just because laws are fuzzy around their working doesn’t make them wrong.

All in all, it’s a very interesting story of how fabulous opportunities can be created by someone smart and how at times the boundaries of being ethical becomes fuzzy. This post was just a small trailer of an equally breathtaking book “The Flash Boys” by Micheal Lewis. Flash Boys is the work of a phenomenal artist and its a great book to remind ourselves every once in a while what a pure genius looks like.

Do share your suggestions and criticisms about this post and most importantly, keep questioning everything.

Until then….Happy Investing

- Nikhil Mudholkar

Interesting topic for a blog. I have been searching the Internet for fun and came upon your website. askari bank car finance | js bank car loan calculator

ReplyDelete